As we go to press, Cisco Systems (CSCO) is trading for $28.53 per share, so it’s currently at a point where InvestedCentral’s John Hopkins Jr. likes entry.

While most people would probably just buy shares at the market price, I’d prefer to make a “10% Trade” here.

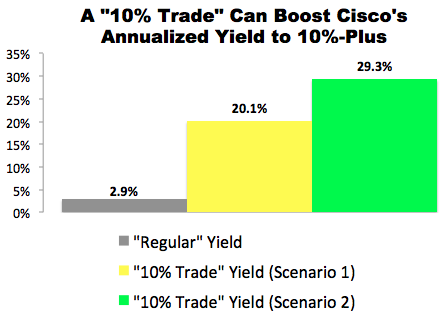

In short, it offers us the opportunity to collect safe, double-digit annualized income on a high-quality dividend growth stock that appears to be undervalued at current levels.

Here’s how it works…

As I write, CSCO is selling for $28.53 per share and the May 15, $29.00 calls are going for about $0.81 per share.

Our “10% Trade” would involve buying 300 shares of CSCO and simultaneously selling three of those calls.

There would be two likely ways this trade will work out, and they both spell at least 10% annualized income.

Let’s take a closer look at each scenario…

Scenario #1: CSCO stays under $29 by May 15

If CSCO stays under $29 by May 15, we’d get to keep our 300 shares.

In the process, we’d receive a guaranteed $243.00 in covered call income ($0.81 x 300 shares) and $63 in dividend income ($0.21 x 300 shares).

The covered call income, which is known as “premium” in the options world, would be collected instantly. The dividend income will be collected when the company pays its next quarterly dividend, which is scheduled for April 22 (shares go ex-dividend on March 31).

At the end of the day, if “Scenario 1″ plays out, we’d receive an instant 2.8% yield for selling the covered call ($0.81 / $28.53) and another 0.7% yield in dividends ($0.21 / $28.53).

Combined, we’d be looking at capturing a 3.6% yield in 65 days, which works out to a 20.1% annualized yield.

[hana-code-insert name=’adsense-article’ /]Scenario #2: CSCO climbs over $29 by May 15

If CSCO climbs over $29 by May 15 our 300 shares will get sold (“called away”) at $29 per share.

In “Scenario 2” — like “Scenario 1” — not only would we get to keep the $243 in covered call income ($0.81 x 300 shares) and be in line to collect $63 in dividend income ($0.21 x 300 shares), but we’d generate $141.00 in capital gains (($29-$28.53) x 300) as well.

In this scenario, excluding commissions, we’d be looking at a probable $447.00 profit.

From a percentage standpoint, this “10% Trade” would deliver an instant 2.8% yield for selling the covered calls ($0.81 / $28.53), a probable — assuming shares don’t get called away too early — 0.7% yield from dividends ($0.21 / $28.53), and a 1.6% return from capital gains ($0.47 / $28.53).

Excluding commissions, we’d be looking at a 5.2% total return in 65 days, which works out to a 29.3% annualized yield from CSCO.

Like this setup? Here’s how we’d make the trade…

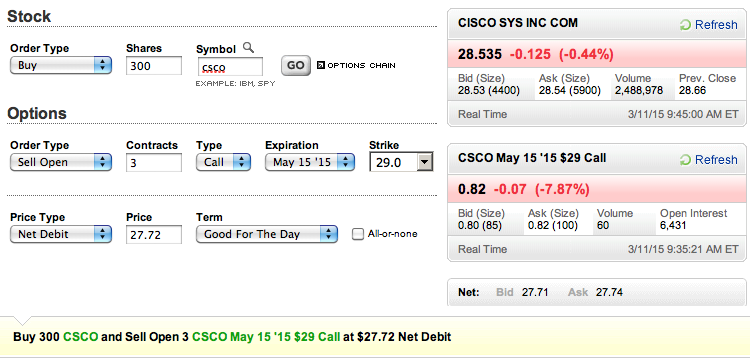

Place a “Buy-Write” options order with a Net Debit price of as close to $27.72 as you can get (the lower the better). Here’s how the order would look in E*Trade: